Buy a House

Buy with Tulsa's Top Realtor

Looking for homes for sale in Tulsa and an easy, stress-free buying experience? Our experienced real estate agents know the Tulsa market inside and out and are dedicated to helping you find the right home at the right price. From understanding neighborhood trends to negotiating the best terms, we provide expert guidance every step of the way.

Explore the latest homes for sale and let our trusted real estate agents make your move simple, confident, and rewarding.

How Can We Help?Estimate Your Monthly Payment

Simplified mortgage payment estimate, without taxes, insurance or fees.

Price

Interest Rate %

Loan Term (Years)

Down Payment %

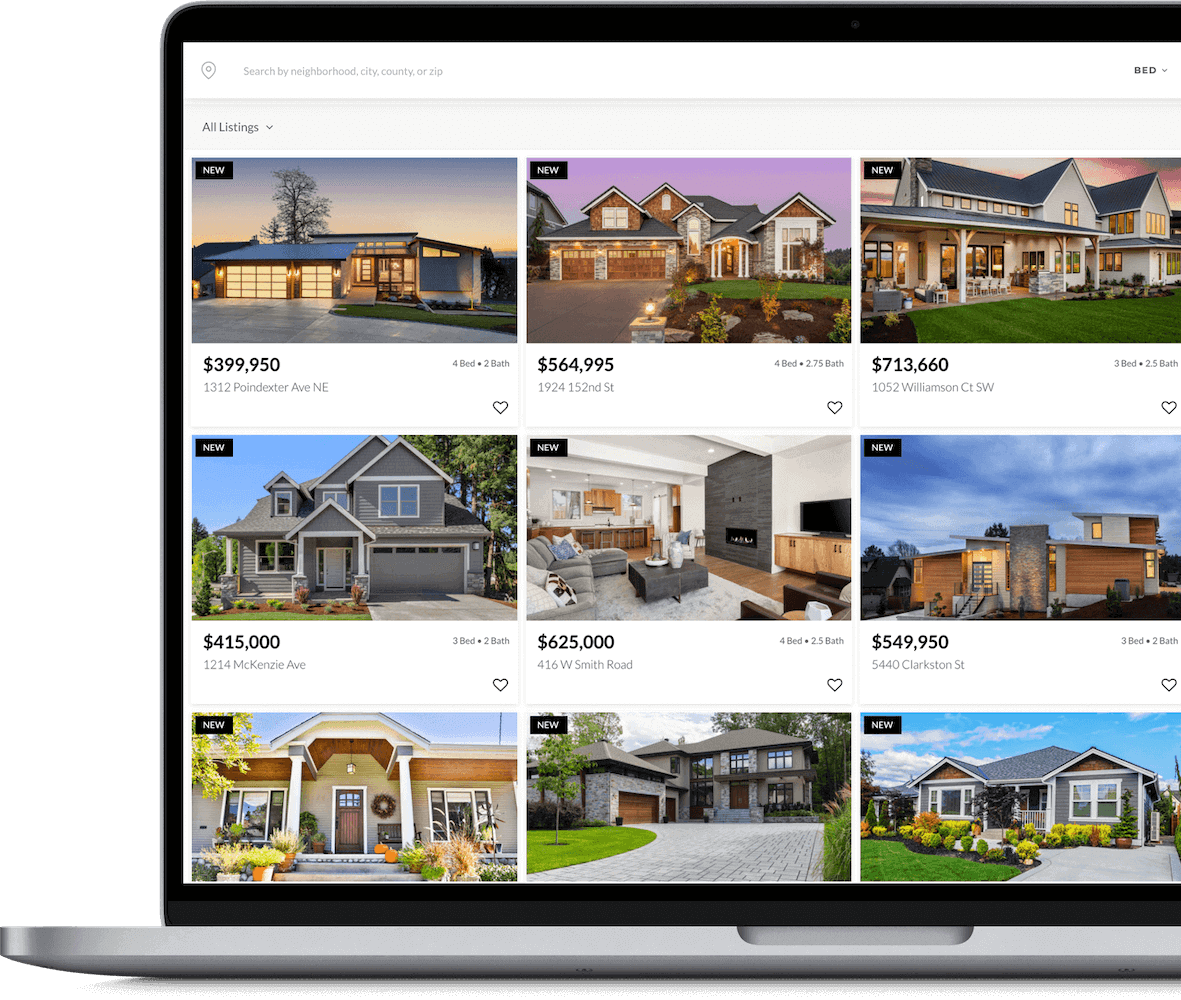

Start Your Home Search

Ready to Explore Tulsa Homes for Sale?

Our website makes it easy to search updated listings, compare neighborhoods, and discover properties that match your must-have features. Our local expertise ensures that you’re seeing accurate information curated by experienced real estate agents who know the Tulsa market inside and out.

Start your home search here and get immediate access to the tools and insights that help buyers find the right home faster.

Start Searching

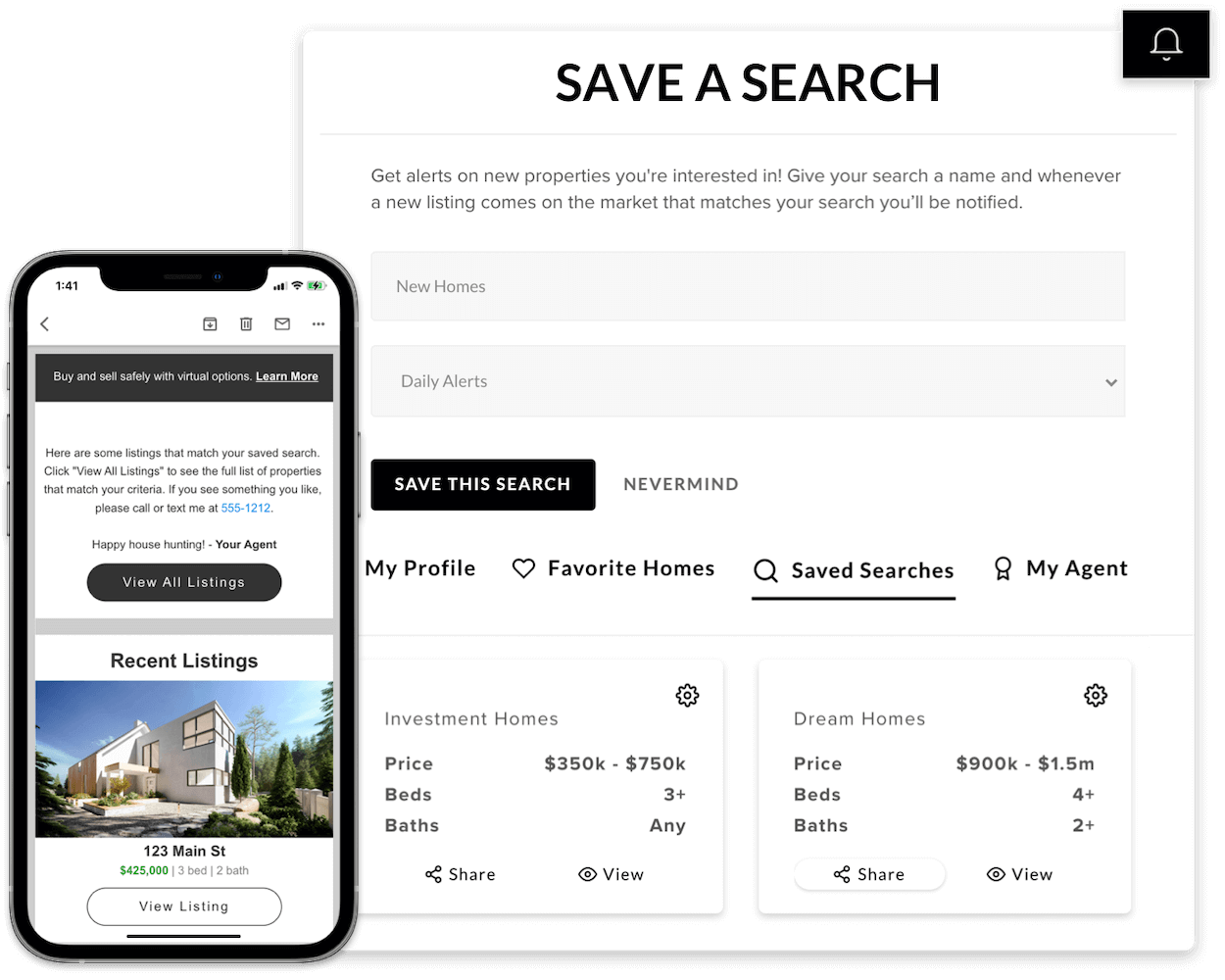

Sign Up for Listing Alerts

Be the first to know when a new property hits the market

Listing Alerts give you the edge over others looking to buy – once you register for Listing Alerts, an email is delivered straight to your inbox the moment a new property that matches your wish list criteria hits the market, enabling you to act fast.

Get Set UpSave and See Listings

Favorite properties and tour homes

When you find a property you love, click the “ SAVE” button at the top of the property details page. This will bookmark the property in your favorites section so you can easily view it whenever you visit this website. Favoriting listings also helps define which properties you are most interested in so that relevant Listing Alerts are both accurate and timely.

Click the "IN PERSON TOUR" button beneath the calendar to schedule a showing online or call to set an appointment to visit the home, where you can ask any questions to help make a more informed decision.

Search Listings

Making an Offer and Closing

Partners throughout the home buying process

When you find a home you love, it’s time to submit an offer. Once your offer is submitted by your agent and accepted (typically after some negotiation), the next steps are moving through the inspection, appraisal, and closing processes in the most stress-free way possible. In addition to partnering with experts in each of these fields, having a knowledgeable agent to oversee the escrow process and ensure each deadline is being met on time is critical. You can rest assured that your agent is always acting in your best interest with a dedicated buyers agreement in place.

With the right support, each step of the homebuying process will feel seamless and easy so that you can focus on getting the keys, throwing a housewarming party, and making lasting memories in your new home!

Let's Connect